Bayport Financial Services — Affordability Review Learnership 2025/2026: Guide for South African Jobseekers

If you’re a young, motivated South African looking to start a career in financial services, the Bayport Financial Services Affordability Review Learnership for 2025/2026 is a strong opportunity to gain workplace experience, a nationally recognised qualification and practical skills in credit assessment and client engagement. This long-form guide explains everything the typical applicant needs to know: who should apply, minimum requirements, how to prepare and apply, what to expect during the learnership, common challenges and practical tips to help you succeed.

Introduction — what is the Affordability Review Learnership?

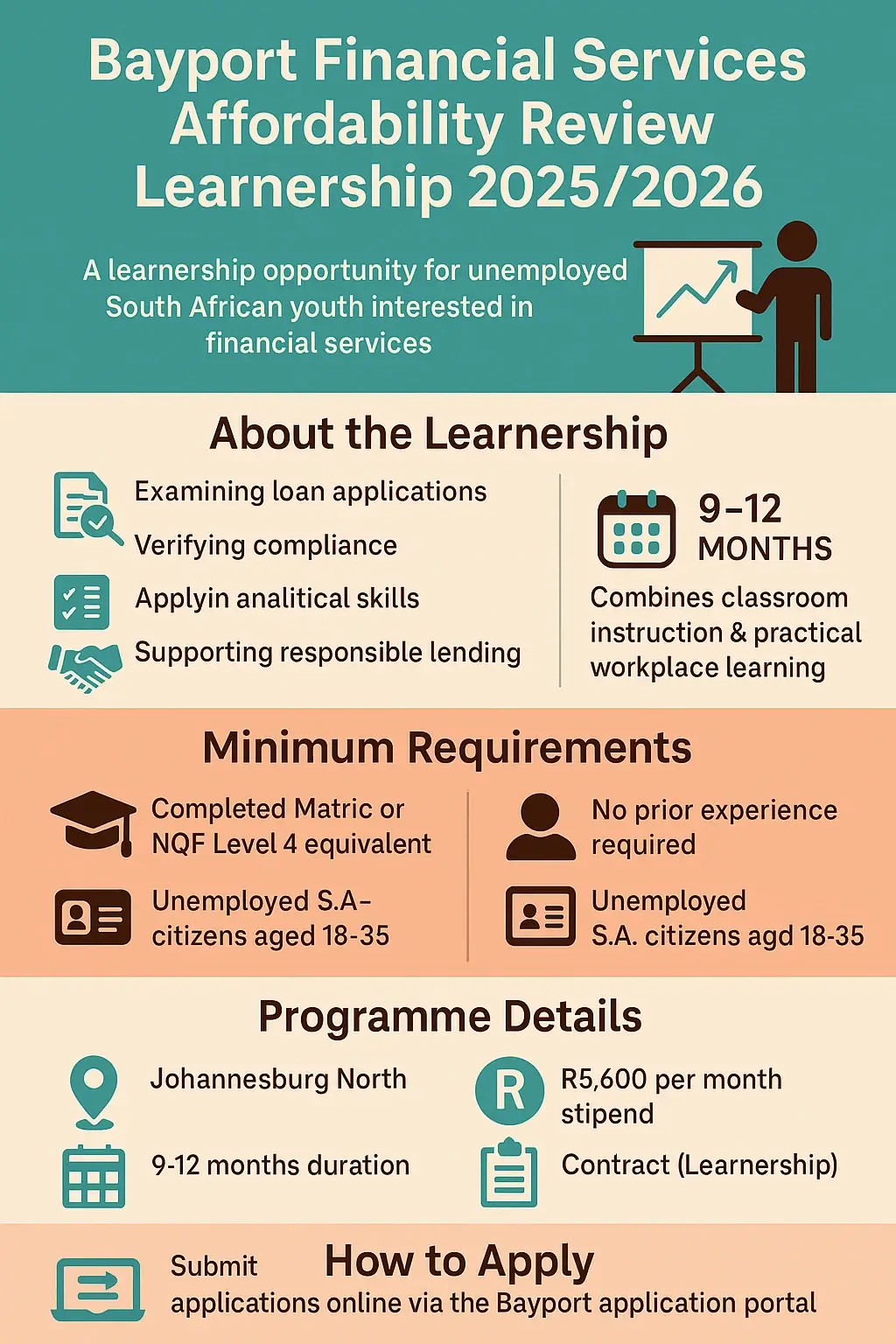

Learnerships are structured workplace-based training programmes tied to a formal qualification under the South African SETA framework. The Bayport Affordability Review Learnership trains learners to assess loan and credit applications for accuracy and compliance with affordability rules and company policy. The programme mixes classroom-based learning with on-the-job experience and is typically scheduled for about 9–12 months. The advertised position for 2025/2026 is based in Johannesburg North and includes a monthly stipend (advertised at R5,600) to help learners cover living and transport costs while they train. For the specific Bayport listing and to apply you should use Bayport’s official careers portal.

Why this learnership matters — opportunities and outcomes

Real workplace experience that employers value

Most entry-level finance hires look for demonstrable experience. Completing a learnership gives you supervised, on-the-job exposure to real files, company systems and work processes that easily beats academic theory alone. You’ll work with real loan applications, learn how to interpret payslips, verify supporting documentation and apply affordability calculations — all under supervision and as part of a skills plan aligned to a recognised qualification. Employers often prefer candidates who have completed learnerships because they arrive work-ready.

A nationally recognised qualification and a clearer career path

On successful completion, most learnerships award an NQF-aligned qualification that is recognised across industry. That formal credential opens doors to permanent roles in customer service, credit administration, collections, or further study in finance and accounting. For many learners, a learnership is the turning point from being unemployed to holding a structured, payroll-backed role.

Earn while you learn

Unlike unpaid internships, most corporate learnerships provide a monthly stipend. Bayport’s Affordability Review Learnership lists a stipend (R5,600 per month in the current advert), which helps learners with transport and basic living costs while they complete training. Although stipends vary by employer and location, the presence of a stipend makes learnerships accessible to candidates who cannot afford long unpaid placements.

Who should apply — eligibility and minimum requirements

Before you apply, check the official job advert. Typical minimum requirements for the Bayport Affordability Review Learnership include:

- South African citizenship (or as specified in the advert).

- Age criteria commonly target youth (the advert indicates applicants between 18 and 35 — verify the ad for exact limits).

- Completed Matric (Grade 12) or an equivalent NQF Level 4 qualification.

- Unemployed at the time of application and not enrolled in formal full-time study or training.

- No prior workplace experience required — the role is entry-level and designed for learners.

Always confirm the exact criteria on Bayport’s official listing (use the reference number shown on the advert — for example Ref: BAYR255 where provided). Applying when you meet every advertised requirement reduces the chance of automatic disqualification.

How to apply — step-by-step (practical checklist)

1. Read the advert carefully and gather documentation

Open Bayport’s live vacancy listing and read every line. Collect digital copies of:

- Your updated CV (PDF preferred).

- Certified copy of your ID document (scan or photo).

- Your Matric certificate or proof of NQF Level 4 qualification (certified copy if requested).

- Any additional documents the advert lists (e.g., proof of residency, affidavit if applicable).

Tip: Make sure scans are clear and file names are professional — e.g., CV_Jane_Doe.pdf, ID_Jane_Doe.pdf.

2. Apply via the official Bayport careers portal

Employers manage applications differently — many require you to apply through their online portal and upload documents. Bayport’s recruitment portal lists current opportunities and allows CV upload or an online application form. Use the official page (the Bayport careers / current opportunities page) rather than third-party reposts when possible.

3. Tailor your CV and cover note

Highlight relevant skills: attention to detail, basic numeracy, reliability, communication and any experience volunteering, working in customer service, or handling basic financial tasks. Keep your CV concise (1–2 pages where possible) and honest. A short cover note (2–4 sentences) explaining why you’re a fit can help recruiters skim quickly and remember your application.

4. Register with official portals and job boards

Registering on SETA learner portals and large job boards increases visibility. Create a learner profile on Services SETA’s Learner Portal and create job alerts on CareersPortal and other reputable listing sites. Register as a work-seeker at your nearest Labour Centre if you are unemployed — the Department of Employment and Labour recommends this for learnership access.

5. Apply early and follow up professionally

Learnerships can close when positions are filled rather than at a fixed closing date. Apply early, then politely follow up if the advert allows — one brief email or phone call after two weeks is acceptable. If shortlisted, prepare for assessments and interviews (see the next section).

What to expect during the learnership — training, assessments and daily work

Structured training + on-the-job learning

The Bayport learnership combines classroom instruction (learning modules on credit, compliance, customer engagement and the legislative environment) with supervised workplace learning where you’ll handle loan applications, verify documentation and learn company systems. Most programmes include regular assessments and mentorship from experienced staff.

Performance assessments and qualification outcomes

Your progress is assessed through workplace evidence, practical checks and sometimes short tests. Successful completion usually results in a SETA-aligned qualification or statement of results, which you can use to apply for other finance roles or further studies.

Working hours and employment conditions

Learnerships are employment contracts that must include training time and study time. The Basic Conditions of Employment Act and Department of Employment and Labour guidance outline the rights of learners, acceptable working hours, and what should be in a learnership contract. Always check your contract before signing and keep a copy.

Common challenges applicants and learners face (and how to prepare)

High competition

Many entry-level applicants compete for learnership places. Improve your chances by tailoring your CV, applying early and registering on learner portals so employers can find you. Consider applying to multiple learnerships in the same period to increase your odds.

Document certification delays

Many employers require certified copies of ID and qualifications. Plan ahead — certified copies can be obtained at police stations, post offices or a commissioner of oaths. Avoid last-minute panic by certifying documents before you apply.

Transport and punctuality pressures

Even with a stipend, transport and punctuality matter. Map your route to the workplace in advance, consider public transport timetables or carpool options, and factor in contingencies for weather and traffic.

Managing workload and study time

Learnership participants juggle workplace duties with classroom learning and assessments. Good time management, clear communication with mentors and early planning for assignment deadlines will reduce stress and improve outcomes.

Practical tips to stand out in the application and on the job

- Polish the basics: neat CV, no spelling errors, clear contact details and a professional email address.

- Show measurable examples: where possible, list achievements (e.g., “Managed cash reconciliation at a school tuckshop” or “Volunteered to assist with administration at a community centre”).

- Demonstrate soft skills: highlight empathy, patience and communication — important for affordability review roles that often deal with clients in financial distress.

- Refresh basic numeracy: be comfortable with percentages, simple budgeting and reading payslips — these are core to affordability assessments.

- Ask good questions: at interview or during the learnership, asking structured, curious questions demonstrates engagement and the right mind-set for learning roles.

- Be punctual and reliable: attendance and reliability are often the first filters employers use when deciding who to keep after the learnership ends.

- Network with purpose: connect with Bayport on LinkedIn, follow their company page and engage politely — recruiters often notice candidates who take a genuine interest in the employer.

Useful resources — official sites and portals

- Bayport Careers — Current Opportunities — Bayport’s official careers portal lists current vacancies and the Affordability Review Learnership. Apply via the official listing to ensure your application is recorded.

- Department of Employment and Labour — guidance on learnerships, contracts and worker rights in South Africa. This is the authoritative source for your rights and obligations during a learnership. Register as a work-seeker at a Labour Centre if you are unemployed.

- Services SETA — Learner Portal — register as a learner so training providers and employers can find you for opportunities in the services sector. Use the official learner registration page to create your profile.

- CareersPortal — a trusted aggregator for learnerships, internships and graduate programmes across South Africa; useful for comparison and application tracking. }

- Local job boards and reputable aggregators such as StudentRoom, BigEasy, Recruite and others often republish corporate learnership adverts — but always click through to the employer’s official portal before applying to avoid scams.

Safety tips — avoid scams and protect your personal information

Unfortunately, scams targeting jobseekers exist. Protect yourself:

- Only apply through official employer portals or recognised government/SETA websites.

- Never pay money to apply for a job or pay for the right to apply — legitimate employers do not ask for application fees.

- Be wary of adverts that ask for excessive personal information at the application stage (e.g., bank PINs or full banking login details).

- If an advert seems suspicious, cross-check the vacancy on the company’s official site or the Department of Employment and Labour pages before applying.

What happens after the learnership ends?

Completion of a successful learnership often increases your chances of being offered a permanent role with the employer or being recommended for another employer within the sector. If no permanent offer is available, use the qualification and workplace experience to apply for roles in credit administration, customer support, collections or further study. Keep records of your workplace evidence and assessment results — these will be valuable when applying elsewhere.

Sample application timeline (what to expect)

Below is a typical timeline for a learnership application — timelines vary by employer:

- Days 0–7: Prepare documents and apply online via the official Bayport careers portal.

- Days 7–21: Shortlisting and initial screening; some employers use online assessments or short telephonic interviews.

- Days 21–35: Formal interviews (in-person or virtual) and possible competency checks.

- Days 35–60: Final selection, contract issuance and induction scheduling.

- Month 1 onwards: Learnership commences with induction, classroom modules and workplace assignments.

How Wikihii can help you (apply smarter)

If you follow employment and learnership postings, join our channels for updates and practical tips. Visit Wikihii for related career content, guides and tailored posts about learnerships and early-career opportunities. You can also join our WhatsApp channel to get immediate alerts when new learnerships and vacancies are published: Wikihii WhatsApp channel.

More Internship & Graduate Programme Opportunities

Applicants looking for similar graduate programmes may also consider these opportunities:

- GEPFuture Graduate Internship 2026

- Eskom Engineering Internships 2026

- NCR TVET College 2026 ICT Internships

- Thabo Mofutsanyana TVET Graduate Programme

Conclusion — should you apply?

If you meet the basic eligibility criteria (Matric/NQF4, South African citizen, unemployed and not in full-time study) and are motivated to enter the financial services sector, the Bayport Affordability Review Learnership 2025/2026 is a practical, employer-backed route to a recognised qualification and real workplace experience. Prepare accurate, professional documents, register on Services SETA and job portals, apply early at Bayport’s official careers listing and keep an eye on communications during shortlisting. With a focused application and the right preparation, a learnership can be the start of a stable and rewarding career path in finance.

Check all available opportunities here:

Internships

Return to our Homepage to explore more student guides and opportunities:

Homepage