How to Register for UIF and Other Employee Benefits in South Africa

Understanding and accessing employee benefits in South Africa is an essential part of ensuring financial security and workplace protection. One of the most important benefits available to employees is the Unemployment Insurance Fund (UIF), which provides financial assistance in cases of unemployment, illness, maternity, or adoption leave. Beyond UIF, South African workers may also have access to additional benefits such as pension or retirement funds, medical aid, leave pay, and occupational injury compensation, depending on their employer and employment contract. Knowing how to properly register and claim these benefits is crucial for safeguarding your rights and ensuring that you receive the support you are entitled to.

For many South African employees, registering for UIF and other benefits can seem overwhelming due to the various forms, requirements, and deadlines involved. However, the process is designed to protect workers and provide a safety net in times of need. By understanding the registration steps, eligibility criteria, and documentation required, employees can confidently navigate the system and maximize the advantages available to them. This is particularly important in a country where job security may fluctuate, and financial protection during periods of unemployment or illness can make a significant difference in an individual’s life.

Moreover, awareness of your employee benefits in South Africa empowers you to make informed decisions about your career, health, and future financial planning. Proper registration ensures access to benefits like unemployment payments, maternity or paternity leave, medical aid contributions, retirement savings, and compensation for workplace injuries. It also helps employees understand their rights, avoid penalties, and ensure that employers comply with legal obligations under South African labor law.

This guide will provide a detailed, step-by-step explanation of how to register for UIF and other key employee benefits in South Africa, highlighting practical tips, eligibility requirements, and the documentation needed to complete the process smoothly. Whether you are a new employee, recently hired, or transitioning between jobs, understanding how to access these benefits will give you peace of mind, protect your financial wellbeing, and ensure that you are fully prepared to take advantage of all the rights and support available to South African workers.

What is UIF and Why It Matters

The Unemployment Insurance Fund (UIF) is a vital social security program in South Africa that provides financial support to employees during periods when they are unable to earn a regular income. Administered by the Department of Employment and Labour, UIF is designed to protect workers in situations such as unemployment, maternity or paternity leave, and temporary illness or injury, ensuring that they have access to a safety net while they transition through challenging times.

For employees who become unemployed, UIF offers temporary financial relief to help cover essential living expenses while they search for new employment. Similarly, it provides income replacement during maternity or paternity leave, allowing parents to focus on family care without the added stress of financial strain. Employees who must take sick leave due to illness or workplace injury can also benefit from UIF, which helps maintain some level of income until they are able to return to work.

Employers in South Africa are legally required to contribute to UIF on behalf of their employees, typically deducting a percentage of each worker’s salary and making matching contributions. This mandatory system ensures that all qualifying employees are covered, regardless of the size of the organization or the industry. Despite being employer-funded, it is the responsibility of employees to ensure they are correctly registered and that contributions are being made on their behalf. Failure to register or monitor UIF contributions could result in delays or difficulties when claiming benefits.

In essence, UIF is more than just a legal obligation—it is a critical financial safety net for South African workers. It provides peace of mind, supports families during difficult periods, and ensures that employees have access to assistance when life circumstances temporarily prevent them from earning an income. Understanding UIF, how it works, and why it matters is an essential step for every employee seeking to protect their rights and secure their financial well-being.

Learn more about related processes in our How-to Guides.

Who is Eligible for UIF in South Africa

Not every worker automatically qualifies for the Unemployment Insurance Fund (UIF) in South Africa, so understanding the eligibility criteria is essential. UIF is designed to provide financial support to employees who meet specific requirements, ensuring that the fund benefits those who genuinely need assistance during periods of unemployment, illness, or parental leave.

To be eligible for UIF, you must be a South African citizen, permanent resident, or a foreigner legally employed in the country. This ensures that all contributors to the fund can access its benefits when needed. Additionally, you must be currently employed and earning a monthly salary of up to R17,712, in line with the latest UIF regulations. While this cap may change over time, it generally applies to most formal-sector employees and ensures that contributions are proportional to income.

Another key requirement is that you must be contributing to UIF through your employer. Contributions are automatically deducted from your monthly salary, with your employer making an equal contribution on your behalf. This combined contribution forms the basis of your eligibility and determines the benefits you can claim in the event of unemployment, maternity leave, sick leave, or workplace injury. Employees who are not registered or whose contributions are not up to date may face delays or complications when claiming UIF benefits.

In summary, UIF eligibility in South Africa is based on three main factors: citizenship or legal work status, being employed within the qualifying salary range, and active contributions through your employer. Understanding these criteria ensures that employees can take full advantage of the financial protections offered by UIF, providing peace of mind and security during unexpected changes in employment or personal circumstances.

Tip: Even casual or part-time workers can qualify if contributions are made.

How to Register for UIF

Registering for the Unemployment Insurance Fund (UIF) in South Africa is a crucial step for ensuring that you can access financial support during periods of unemployment, maternity leave, illness, or workplace injury. Fortunately, the process is straightforward and can be completed either through your employer or individually, depending on your situation.

1. Registration Through Your Employer

In most cases, your employer is responsible for registering you for UIF. When employers submit their monthly UIF contributions to the Department of Employment and Labour, they typically include all eligible employees in the system. This automatic registration ensures that your contributions are recorded, and you become eligible to claim benefits when needed. Employees should always confirm with their HR department or payroll officer that they have been properly registered to avoid complications later.

2. Self-Registration

If your employer has not registered you, or you are unsure about your registration status, you can register for UIF individually. Self-registration can be done online through the Department of Labour website or in person at your nearest labour centre or UIF office. During self-registration, you will need to provide personal information such as your South African ID or work permit, proof of employment, and banking details to receive payments. This process ensures that even employees whose employers fail to register them are protected under the UIF system.

It is important to note that keeping your registration details up to date, including your contact information and employment status, is critical for smooth processing of claims. By ensuring that you are properly registered, either through your employer or individually, you safeguard your right to financial support and other employee benefits offered under South African labour law.

- Through Your Employer – Most employers register employees automatically when submitting monthly contributions.

- Self-Registration – If your employer hasn’t registered you, you can visit the Department of Labour website or local labour office to register.

Required information includes:

- ID or Passport number

- Personal contact details

- Employment details (salary, start date, employer info)

Other Key Employee Benefits

In addition to UIF, employees may access:

- Medical Aid Benefits – Some employers provide medical aid contributions

- Pension or Retirement Funds – Long-term financial security

- Leave Entitlements – Annual, sick, and family responsibility leave

- Workplace Injury Benefits – Compensation for work-related injuries

Understanding these benefits ensures you maximize your rights as an employee.

Keep Your Information Updated

Always make sure your employer has your correct personal details. This ensures:

- UIF claims are processed correctly

- Pension or retirement contributions are accurate

- You receive notifications about new benefits

Filing a UIF Claim

Filing a Unemployment Insurance Fund (UIF) claim is an essential step for employees in South Africa who find themselves unemployed, on maternity or paternity leave, or unable to work due to illness or injury. Knowing how to submit your claim correctly ensures that you receive the financial support you are entitled to in a timely manner.

The first step is to gather all required documents. This typically includes your South African ID or work permit, bank account details for payments, proof of employment, and relevant supporting documents such as a termination letter, maternity leave certificate, or medical certificate. Having these documents ready before you start the application process can help avoid delays and streamline your claim.

Once your documents are prepared, you can submit your UIF claim either through the UIF Online system or in person at your nearest labour office or UIF centre. The online system is convenient and allows for faster processing, while in-person submission may be necessary if you require assistance or need to verify documents physically. Carefully follow the instructions on the application forms to ensure all information is complete and accurate.

After submitting your claim, you can track its status online or via SMS notifications. The UIF system provides updates on whether your claim has been approved, processed, or if additional information is required. Staying proactive and checking your claim regularly helps you respond quickly to any queries and ensures that payments are made without unnecessary delays.

By following these steps and submitting your UIF claim correctly, you secure a vital financial safety net that supports you during periods of unemployment, maternity or paternity leave, and illness. Proper understanding of the claim process not only protects your rights as a South African employee but also ensures peace of mind during transitional periods in your career.

- Gather all required documents (ID, bank details, termination letter, etc.)

- Submit your claim via the UIF Online system or at a local labour office

- Track the status of your claim online or via SMS notifications

Stay Informed About Employee Rights

South African labour laws protect workers’ rights. Staying informed helps you:

- Claim benefits you’re entitled to

- Understand workplace leave policies

- Avoid issues with UIF or employer contributions

For regular updates, join professional communities like the Jobs Connect ZA WhatsApp Channel: Click here

Next Steps: Learn and Apply

Registering for UIF and other benefits is a vital step for all employees. Make sure to:

- Confirm your UIF registration status

- Review your employment contract for other benefits

- Explore our Wikihii How-to Guides for more employment tips

Being proactive about UIF and employee benefits in South Africa ensures financial security and peace of mind in times of need.

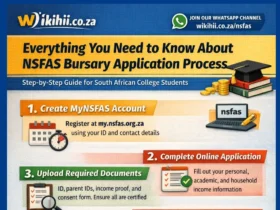

How to Register for UIF and Other Employee Benefits in South Africa [Infographic]

![How to Register for UIF and Other Employee Benefits in South Africa 26 How to Register for UIF and Other Employee Benefits in South Africa [Infographic]](https://wikihii.co.za/wp-content/uploads/2025/10/How-to-Register-for-UIF-and-Other-Employee-Benefits-in-South-Africa-2-1.webp)

Conclusion: How to Register for UIF and Other Employee Benefits in South Africa

Registering for UIF and other employee benefits in South Africa is an essential step for safeguarding your financial well-being, securing workplace protections, and ensuring peace of mind during periods of unemployment, illness, maternity or paternity leave, or workplace injury. By understanding the eligibility criteria, completing the registration process, and submitting claims correctly, employees can take full advantage of the safety nets provided under South African labor law.

UIF acts as a critical financial buffer for employees who face temporary work disruptions, while other benefits—such as pension funds, medical aid, and occupational injury compensation—provide long-term security and support for you and your family. Proper registration ensures that you are entitled to these benefits and that your rights as an employee are protected. It also demonstrates professionalism, responsibility, and awareness of your employment rights, which are valued by employers in South Africa.

Ultimately, being proactive about registering for UIF and other benefits empowers you to navigate your career with confidence. Whether you are a new employee, changing jobs, or seeking to maximize your entitlements, knowing how to access these programs ensures that you can respond effectively to life’s uncertainties while maintaining financial stability. By following the correct procedures, keeping your information up to date, and understanding your benefits, you set yourself up for a secure and protected working life in South Africa.